LAST WEELY RECOMMENDATION:

IN

BULLISH MOMENTUM: STAR ROCKSS ALL HIT TGT 1100 MADE HIGH OF 1210

LOT

SIZE: 500

DAILY

TOTAL PROFIT: 35000 IN JUST TWO LOT

FOR MORE ROCKING CALLS OF FUTURE PLEASE FILL UP THE FORM GIVEN

HERE >>>>>>>>>>>>>>>

DAILY CHART FOR STAR:

FUTURE:

“BUY MARUTI

ABOVE 4200 TGT 4250/4350”

“SELL MARUTI

BELOW 4140 TGT 4100/4050”

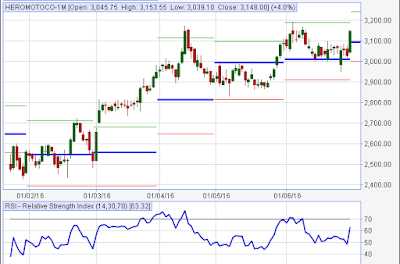

After

showing correction from the higher level, now stock is trading in short term

recovery phase, it is likely to continue the upside move in near term with the

crossing of the resistance level of 4200 as the stock is managing to sustain

above the level of 4250. One may get the targets of 4300,4350 in the stock with

the stop loss of 4140.