“BUY MARUTI

ABOVE 4300 TGT 4315/4325”

“SELL MARUTI

BELOW 4260 TGT 4240/4210”

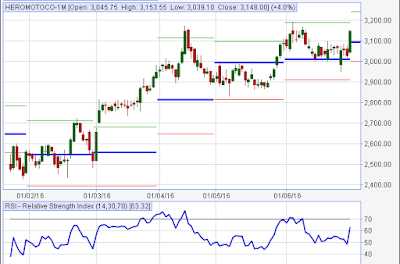

DAILY CHART FOR MARUTI:

Primary trend of the MARUTI is bullish and after giving breakout of its range bound movement, it is

forming continuation pattern in short term charts, it is likely to continue the

positive movement with the breakout of the pattern at the levels of 4300 ; as

the stock is managing to trade above its 50 and 200 days moving averages with

the RSI of 66.65, one may expect the targets of 4325 in the stock if it manages

to sustain above the immediate support level of 8260.Today,Sensex ended

with a gain of 500 points at 26,627. The Sensex opened at 26,358 touched an

intra-day high of 26,647 and low of 26,358.23.The Nifty closed