TO GET BEST STOCK MARKET TRADING TIPS WHATSAPP OR CALL ME ON 8982012608/7772909587 📲

A bullish

candlestick with a long lower shadow was noted on the weekly scale. While

closing well above the key barrier at 18,150 on Friday, the Nifty headline

index formed a long bull candle on the daily chart. Analysts are now seeing an

increasing likelihood of Nifty hitting record highs around the 18,600 mark. Indicators

like RSI and MACD also showed a positive direction in the market. Chart readers

said that Nifty could now rise towards the 18458-18604 band in the near term,

while the 18179-18255 band could offer support. On the derivatives front, the

highest call OI remained at 18,500 strike followed by 18,600 strike while

active. On the put side, the highest OI remained at 18,000 followed by 18,200

strike. Markets were roiled by far below expectations inflation data in

the US, taking this as the long-awaited and hoped-for sign that inflation is

finally beginning to ease. With market guru David Rosenberg pointing out that

this was the biggest downtrend in core retail inflation since April 2020, there

is much to celebrate. US bond yields fell, stocks rose and the dollar

contracted. Expectations of Fed tightening faded, with Fed Fund futures

signaling a lower final rate of just under 5 percent and rate cuts from

November next year. Central banks around the world will breathe a sigh of

relief as the strong dollar has wreaked havoc.

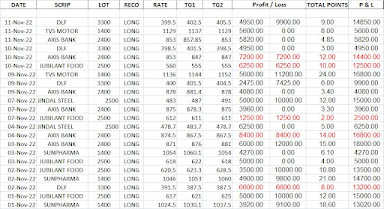

STOCKS FOR THE WEEK AHEAD 👍🏻

SBI,INDIGO,GAIL,HEROMOTOCORP,TITAN,TVS MOTOR,COAL INDIA