We do not Like to Brag..So you better Check Yourself.. Call now 8982012608/7772909587

Tuesday, November 15, 2022

INTRADAY STOCK FUTURE TIPS FOR 15 NOV 2022

We do not Like to Brag..So you better Check Yourself.. Call now 8982012608/7772909587

IMPORTANT TRIGGERS AND NEWS IN NIFTY FOR TODAY 15 NOV 2022

Things you should know before Nifty Open Today. Gear up yourself with all important information pertaining to Stock Market before you Trade in Nifty future and Stock future. Take 5 min before equity market opening to check global clues, Nifty /Bank nifty Support Resistance Levels ,Stock results, Stock future in Ban and Important news. You may find Best Stock Futures to Trade Today also if you are lucky.Stay Tuned for Best Live market Stock future and Nifty/Banknifty Future Trading Tips which will be posted frequently here with proper Target And Stoploss. Don't ever hesitate to contact on 8982012608 for Best Stock Future Tips.

18362.75 +33.60 (+0.18%)

NIFTY RESISTANCE

17943,18099

NIFTY SUPPORT

17495,17385

STOCK IN BAN

1 PNB

2 GNFC

3 BHEL

4 SUNTV

Stay Tuned for Best Live market Stock future and Nifty/Banknifty Future Trading Tips which will be posted frequently here with proper follow up👍

Monday, November 14, 2022

HOW TO MAKE F&O TRADING PROFITABLE 👍👍

Do you want Best Stock Future Tips on your Mobile? Give A missed call now on 7772909587/8982012608

A stock, index, bond,

or commodity may be the underlying, from which futures and options receive

their value. Let's concentrate more on stock and index futures and options for

the time being. The value of a stock future or option is derived from a stock

like Tata Steel or RIL. An underlying index like the Nifty or the Bank Nifty is

what gives an index future or option its value. The previous few years have

seen a significant increase in F&O volumes in India, which now make nearly

90% of the market.

1. Use F&O more as hedge

than as a trade

This is the fundamental tenet of futures and option trading.

The fact that F&O is a margin industry is one of the factors that attracts

individual investors to it. For instance, you can purchase Nifty for Rs. 10

lakhs by making a just Rs. 3 lakhs in margin payments. You can triple your

capital's leverage thanks to that. However, that is a slightly risky course of

action to take because in futures, just as gains can multiply, losses can

likewise. Additionally, if the price movement goes against you, you must have

enough cash on hand to pay mark to market margins.

The solution is to

consider futures and options as a hedge more. Let's explore this further. If

you own Reliance and purchased it at Rs. 1100 but the CMP is Rs. 1300, you can

sell the futures for Rs. 1305 and lock in profits of Rs. 205 (futures typically

quote at a premium to spot). Any direction the price goes from here, your

profit of Rs. 205 is guaranteed. Similar to this, if you own SBI at Rs. 350 and

are concerned about a downside risk, you can hedge by purchasing a Rs. 2 put

option with a strike price of Rs. 340. You are currently insured up to Rs. 338.

You will earn from the put option and lower the

cost of maintaining the stock if the price of SBI drops to Rs. 320. By having

the appropriate philosophy, you can make F&O work efficiently.

2. Get the trade structure right; strike, premium, expiry, risk

Poor

trade structuring is another factor contributing to traders' failure to execute

F&O trades correctly. What does "structure of a F&O trade"

mean?

• Check for dividends and

see whether the cost of carry is beneficial before buying or selling futures.

• The expiry has a significant impact on futures and option trading. Both

near-month and far-month expirations are available. Although long-term

contracts might lower your costs, they are illiquid, and exiting them can be

challenging.

• Which choice for a strike

should you choose? Despite their cheap appearance, deep OTM (out of the money)

options are typically useless. Deep ITM (in the money) options are worthless,

just like futures.

• Master the art of valuing

options. According to the Black and Scholes model, your trading terminal has an

interface to determine if the option is overvalued or undervalued. Make careful

to buy options at a discount and sell options at a premium.

3. Focus on trade management; stop loss, profit targets

The last thing to focus on is how you manage the trade; more so

when you are trading in F&O. Here is why!

1. Maintaining

a stop loss for all F&O trades is the first step. Keep in mind that this is

a leveraged enterprise, thus stop loss is essential. The stop loss should

ideally be included in the trade from the beginning rather than being added

later. Online trading is above all a disciplined industry.

2. In F&O, you just book profits; everything else is merely book profits. In

the F&O trading industry, you can profit if you actively churn your

capital. Try to do this quickly.

3. Track the greatest amount of money you're willing to lose and adjust your plan

accordingly. Never wager more money than you can lose. Above all, avoid markets

when they are too complex for you to understand.

NET PROFIT 10800/- !!! BOOKED IN TODAY'S OPTION CALL-PUT TIPS

BUYING CALL GIVEN IN TODAY'S POST

ASHOKLEY 155 CALL TARGET ACHIEVED @ 2.5 BUYING CALL GIVEN FROM 1.8

BOOKED PROFIT OF 3500/-

NIFTY 18500 CALL TARGET ACHIEVED @ 58 BUYING CALL GIVEN FROM 41

BOOKED PROFIT OF 1700/-

MUTHHOTFIN 1100 CALL TARGET ACHIEVED @ 26 BUYING CAL GIVEN FROM 21 BOOKED PROFIT OF 1625/-

BOOKED PROFIT OF 1500/-

BOOKED PROFIT OF 2475/-

STOCK OPTION CALLS FOR TODAY 14 NOV 2022

BUY 1 LOT ASHOKLEY 155 CALL @ 1.8 TARGET

BUY 2 LOTS NIFTY 18500 17 NOV CALL @ 41 TARGET 58

BUY 1 LOT MUTHHOTFIN 1100 CALL @ 21 TARGET 26

Looking for best stock future tips? Well you are in luck ..enter your number or call 7772909587/8982012608

Saturday, November 12, 2022

STOCK MARKET PREDICTION FOR NEXT WEEK 14 NOV 2022

TO GET BEST STOCK MARKET TRADING TIPS WHATSAPP OR CALL ME ON 8982012608/7772909587 📲

A bullish

candlestick with a long lower shadow was noted on the weekly scale. While

closing well above the key barrier at 18,150 on Friday, the Nifty headline

index formed a long bull candle on the daily chart. Analysts are now seeing an

increasing likelihood of Nifty hitting record highs around the 18,600 mark. Indicators

like RSI and MACD also showed a positive direction in the market. Chart readers

said that Nifty could now rise towards the 18458-18604 band in the near term,

while the 18179-18255 band could offer support. On the derivatives front, the

highest call OI remained at 18,500 strike followed by 18,600 strike while

active. On the put side, the highest OI remained at 18,000 followed by 18,200

strike. Markets were roiled by far below expectations inflation data in

the US, taking this as the long-awaited and hoped-for sign that inflation is

finally beginning to ease. With market guru David Rosenberg pointing out that

this was the biggest downtrend in core retail inflation since April 2020, there

is much to celebrate. US bond yields fell, stocks rose and the dollar

contracted. Expectations of Fed tightening faded, with Fed Fund futures

signaling a lower final rate of just under 5 percent and rate cuts from

November next year. Central banks around the world will breathe a sigh of

relief as the strong dollar has wreaked havoc.

STOCKS FOR THE WEEK AHEAD 👍🏻

SBI,INDIGO,GAIL,HEROMOTOCORP,TITAN,TVS MOTOR,COAL INDIA

Friday, November 11, 2022

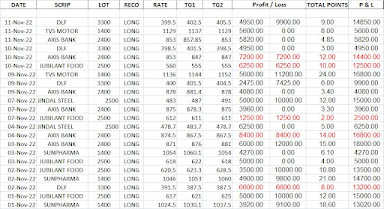

INTRADAY INDEX & STOCK PERFORMANCE (1 NOV - 11 NOV 2022)

INDEX FUTURE NET PROFIT BOOKED 21950/- 💸💵

INTRADAY STOCKS 30150/- PROFIT BOOKED!!!!!

TVS MOTOR FUTURE ACHIEVED 1ST TARGET @ 1137 BUYING CALL GIVEN FROM 1129 BOOKED PROFIT OF 5600/-

NIFTY FUTURE ACHIEVED 1st TARGET @ 18342 BUYING CALL GIVEN FROM 18392 BOOKED PROFIT OF 2500/-

Here We Provide Hedging Based Option Call Put Tips. Call Now for DEMO 8982012608/7772909587