LAST DAILY RECOMMENDATION:

IN

BULLISH MOMENTUM: CENTURYTEX HIT TGT 650 MADE A HIGH OF 654

LOT

SIZE: 800

DAILY

TOTAL PROFIT: 8000 IN JUST TWO LOT

FOR MORE ROCKING CALLS OF FUTURE PLEASE FILL UP THE FORM GIVEN

HERE >>>>>>>>>>>>>>>

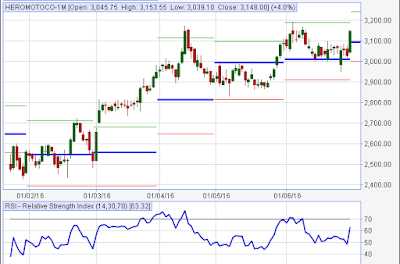

DAILY CHART FOR HEROMOTOCO:

FUTURE:

“BUY HEROMOTOCO

ABOVE 3152 TGT 3175/3195”

“SELL HEROMOTOCO BELOW 3120 TGT 3100/2950”

Sensex ended with a gain of 215 points at 26,740. The Sensex opened at 26,627 touched an intra-day

high of 26,776 and low of 26,606.31.The Nifty closed with a gain of 76

points at 8,204. The Nifty opened at 8,173.10 hitting a high of 8,212.40 and

low of 8,157. Participants are now keenly

watching the rollovers to the next series ahead of the expiry of June

F&O series due tomorrow, auto sales volume data for June and

India Manufacturing PMI for June due on Friday

TOP GAINERS: Bosch, Hero MotCorp, NTPC, BHEL,

Wipro, PowerGrid, GAIL, HCL

TOP LOSERS: Lupin, Coal India, ITC, Bank of Baroda, Bharti Airtel, Tata Motors DVR