FOR BEST CALL-PUT TRADING TIPS JOIN ON WHATSAPP 7772909587📲

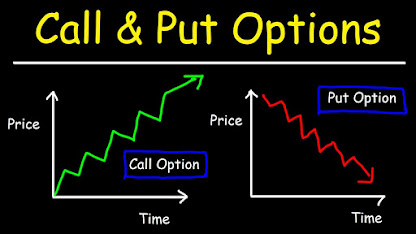

OPTION:- Call option and Put option are the two

main types of options available in the derivatives market. A Call option is

used when you expect the prices to increase/rise. A Put option is used when you

expect the prices to decrease/fall. Options are derivative contracts which have no value of

their own and derive their value from the value of the underlying asset. The

underlying asset can be shares, currencies, commodities etc. An

options contract gives the buyer the right but not the obligation to buy or

sell the underlying asset within a specified date (known as the expiration date) and at a specific price (known as

the strike price). In

options, the buyer of the option has the right of exercising the option or

cancelling it. The loss for the option buyer is limited to the premium paid.

TYPE OF OPTION

1- CALL OPTION

2- PUT OPTION

CALL OPTION-A call option gives the

buyer the right but not the obligation to buy the underlying asset at a particular price

(strike

price) on or before the

expiration date.

PUT OPTION - A put option gives the

buyer the right but not the obligation to sell the underlying asset at a particular price

(strike

price) on or before the

expiration date.

Basic terms relating to call and put options👇

1. Strike Price: Strike price

is the price at which buyers and sellers decide to buy or sell the underlying

asset after a specified period.

2. Spot Price: Spot price is

the current price of the underlying asset in the stock market.

3. Option Expiry: Options contracts

expire on the last Thursday of the month.

4. Option Premium: Option premium is

the non-refundable amount paid upfront by the option buyer to the option seller

(also known as option writer).

5. Settlement: Option contracts

are cash settled in India.

What is the Difference Between Call Option & Put Option?

|